Manitoba IFTA

Fuel-Tax Preparation

You Need to Succeed

Manitoba IFTA Requirements

Who needs an Manitoba IFTA license?

You need an IFTA license if you operate in Manitoba and at least one other jurisdiction with vehicles that are:

- Three or more axles (any weight)

- Over 26,000 lbs. gross or registered weight

- Combined weight over 26,000 lbs.

Who needs to file Manitoba IFTA taxes?

All license holders must file quarterly IFTA tax returns, even if no miles were traveled.

Note: Licenses remain active until officially closed.

How can we help you?

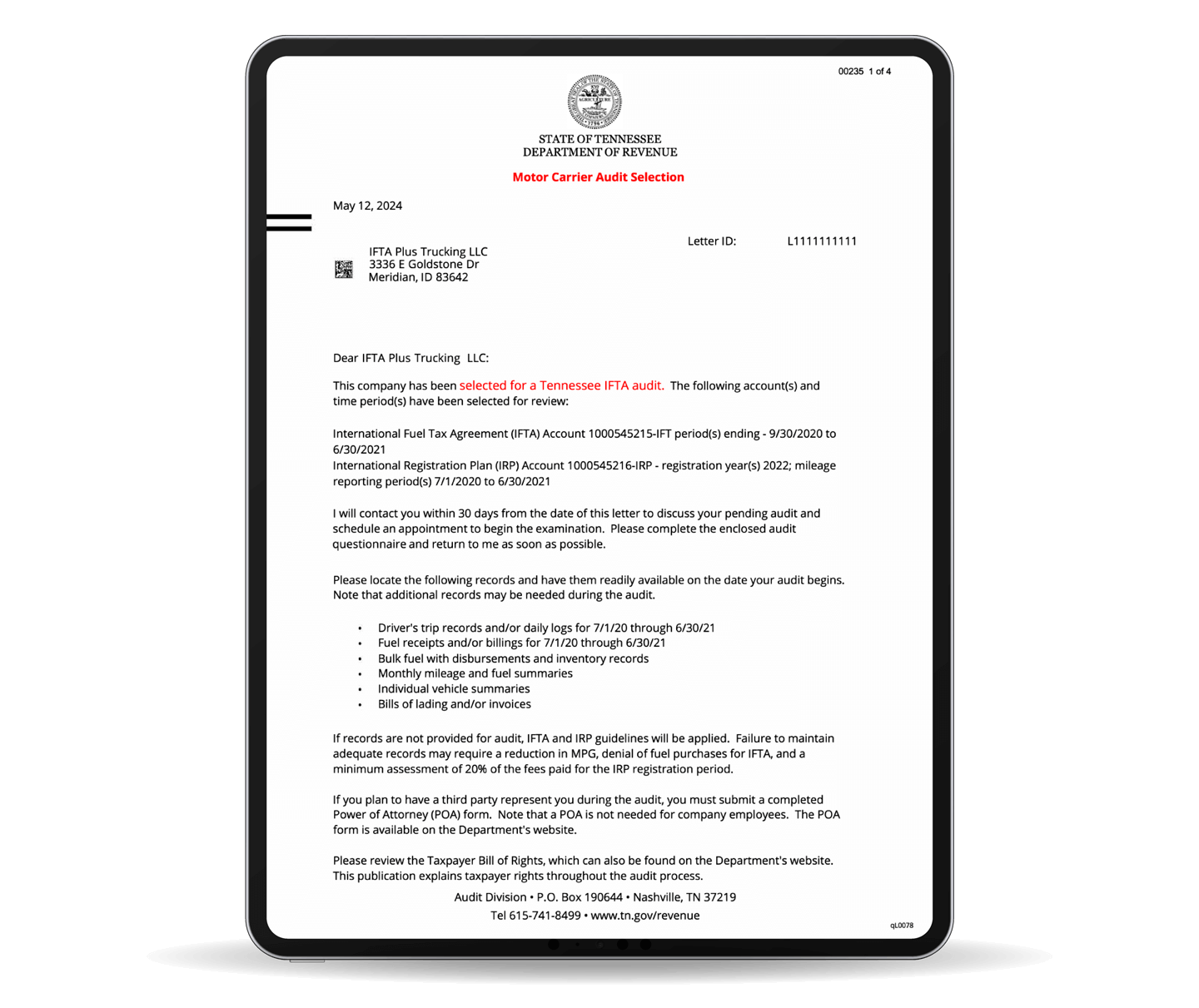

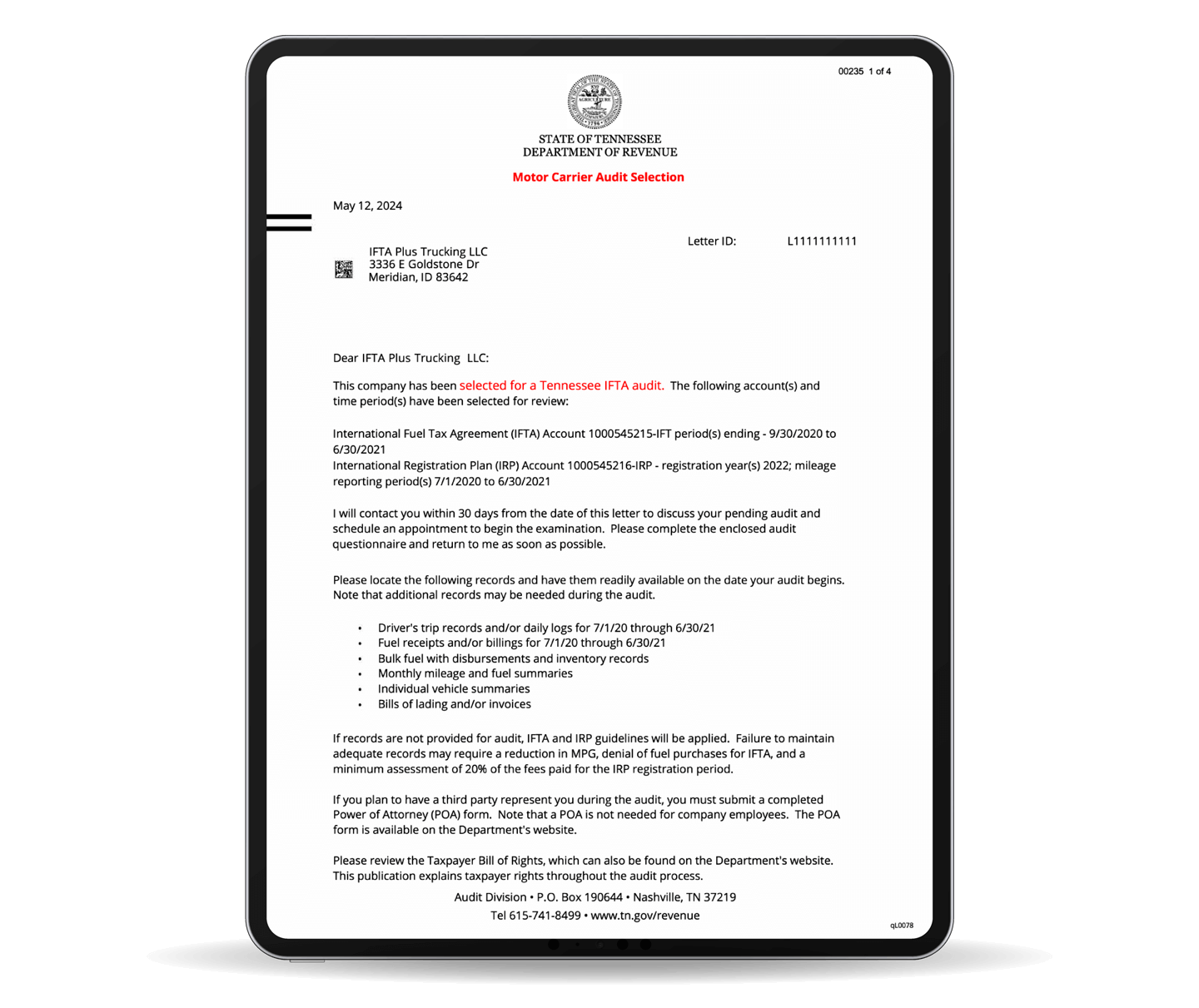

What happens if you file IFTA incorrectly?

What are you risking by submitting an inaccurate IFTA filing?

Even small discrepancies in reported miles or fuel can lead to:

- Costly fines and back taxes

- Delays with renewals or suspended accounts

- Failed audits and penalties

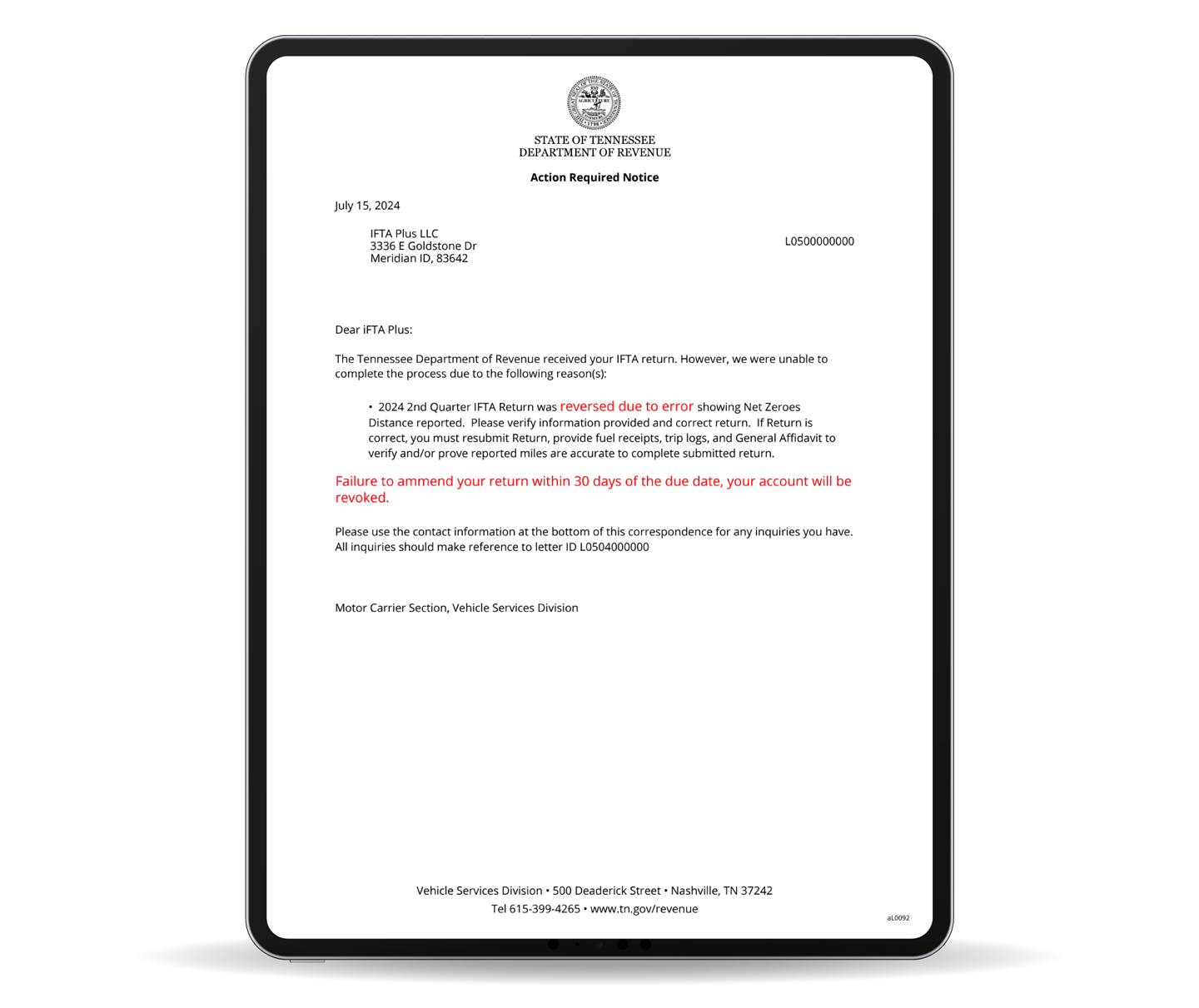

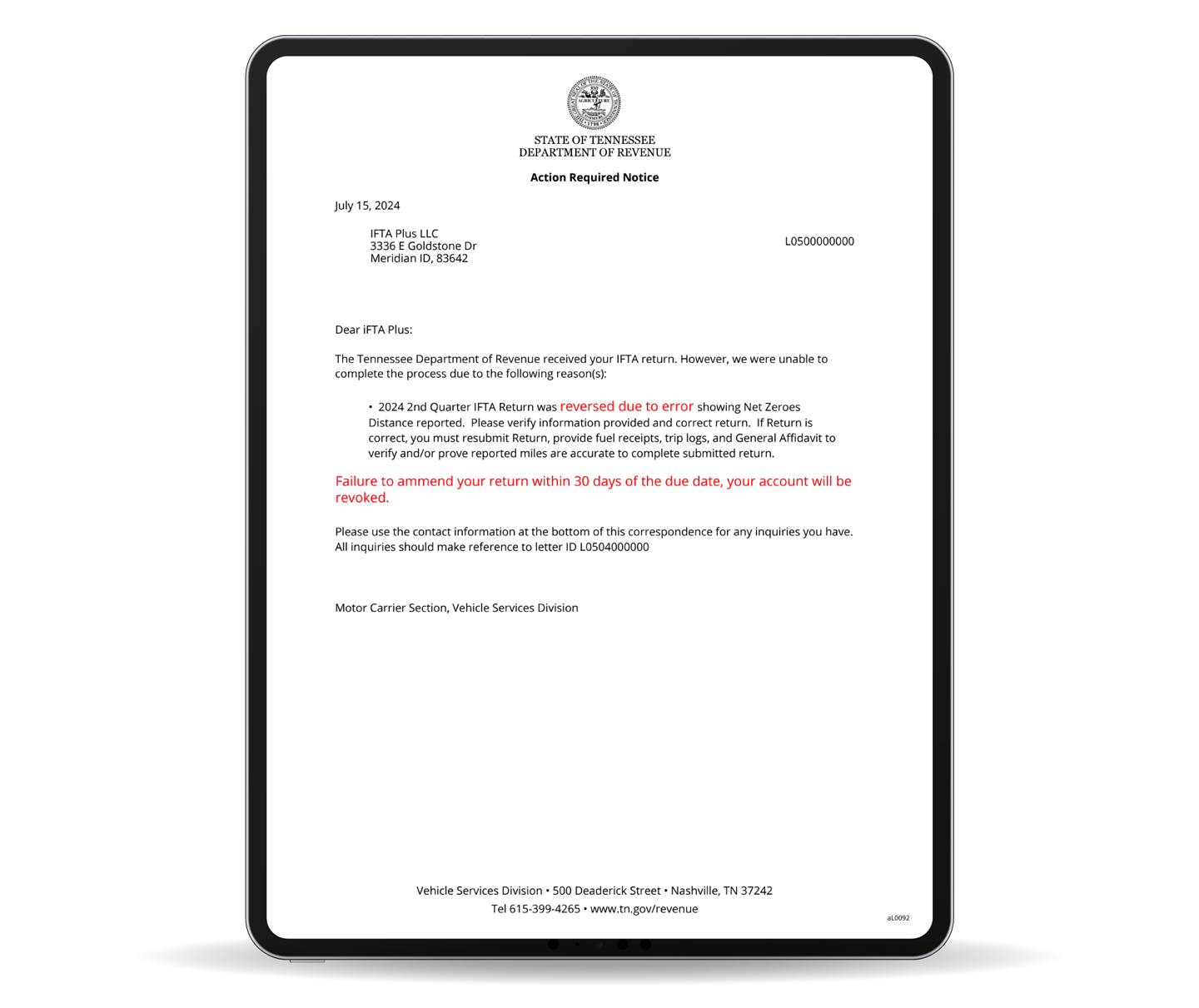

What happens if you file IFTA incorrectly?

What are you risking by submitting an inaccurate IFTA filing?

Even small discrepancies in reported miles or fuel can lead to:

- Costly fines and back taxes

- Delays with renewals or suspended accounts

- Failed audits and penalties

Why do errors happen?

- Mileage and fuel data accumulate quickly — it’s tough to catch every issue. Records often go unnoticed until it’s too late.

- Carriers often depend entirely on ELD IFTA reports, thinking they’re complete — but there’s no way to verify them.

- Fuel card reports may exclude cash purchases or missing transactions.

* When these gaps exist, your IFTA filing will be wrong — and you’ll be held accountable with your base jurisdiction.

Why do errors happen?

- Mileage and fuel data accumulate quickly — it’s tough to catch every issue. Records often go unnoticed until it’s too late.

- Carriers often depend entirely on ELD IFTA reports, thinking they’re complete — but there’s no way to verify them.

- Fuel card reports may exclude cash purchases or missing transactions.

* When these gaps exist, your IFTA filing will be wrong — and you’ll be held accountable with your base jurisdiction.

How to manage your IFTA correctly

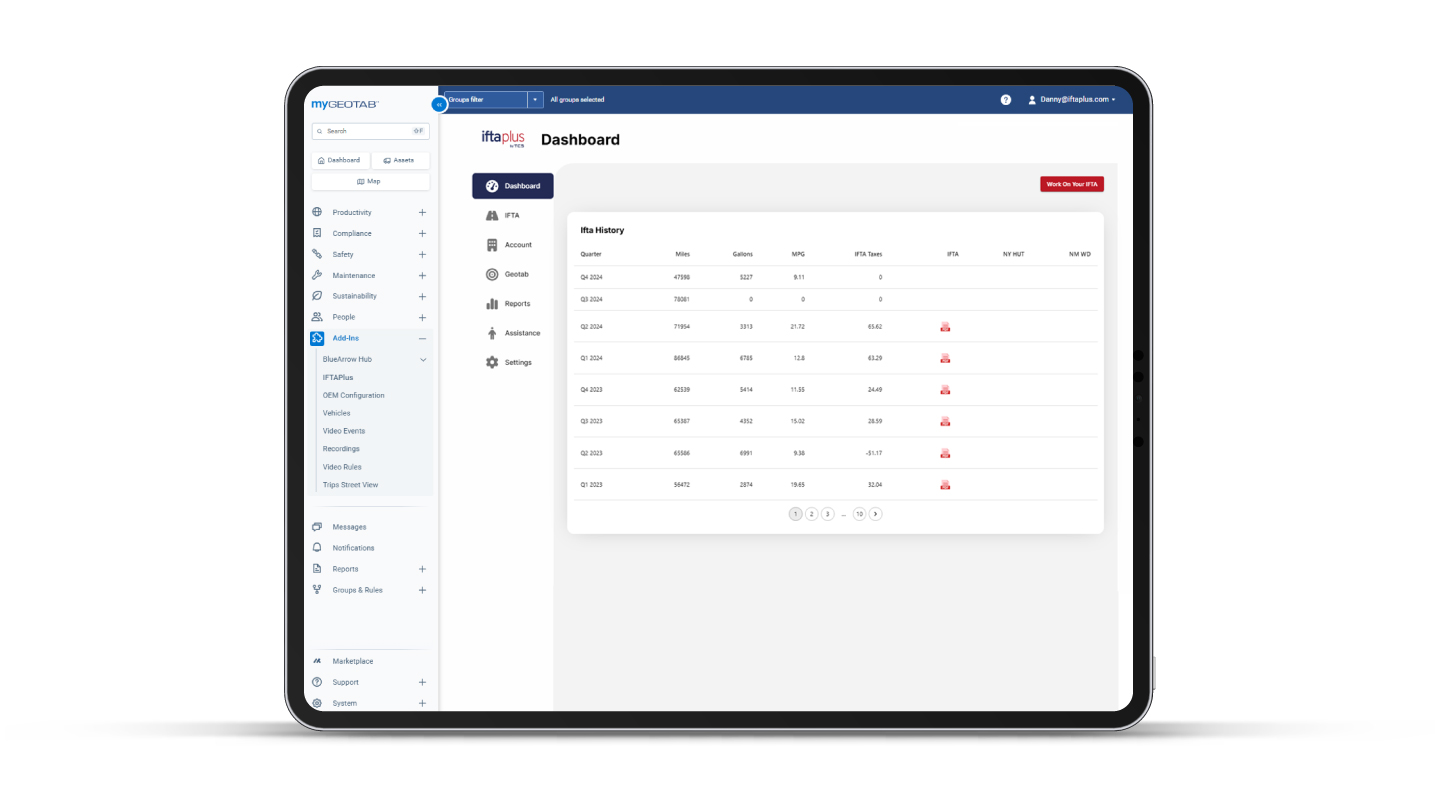

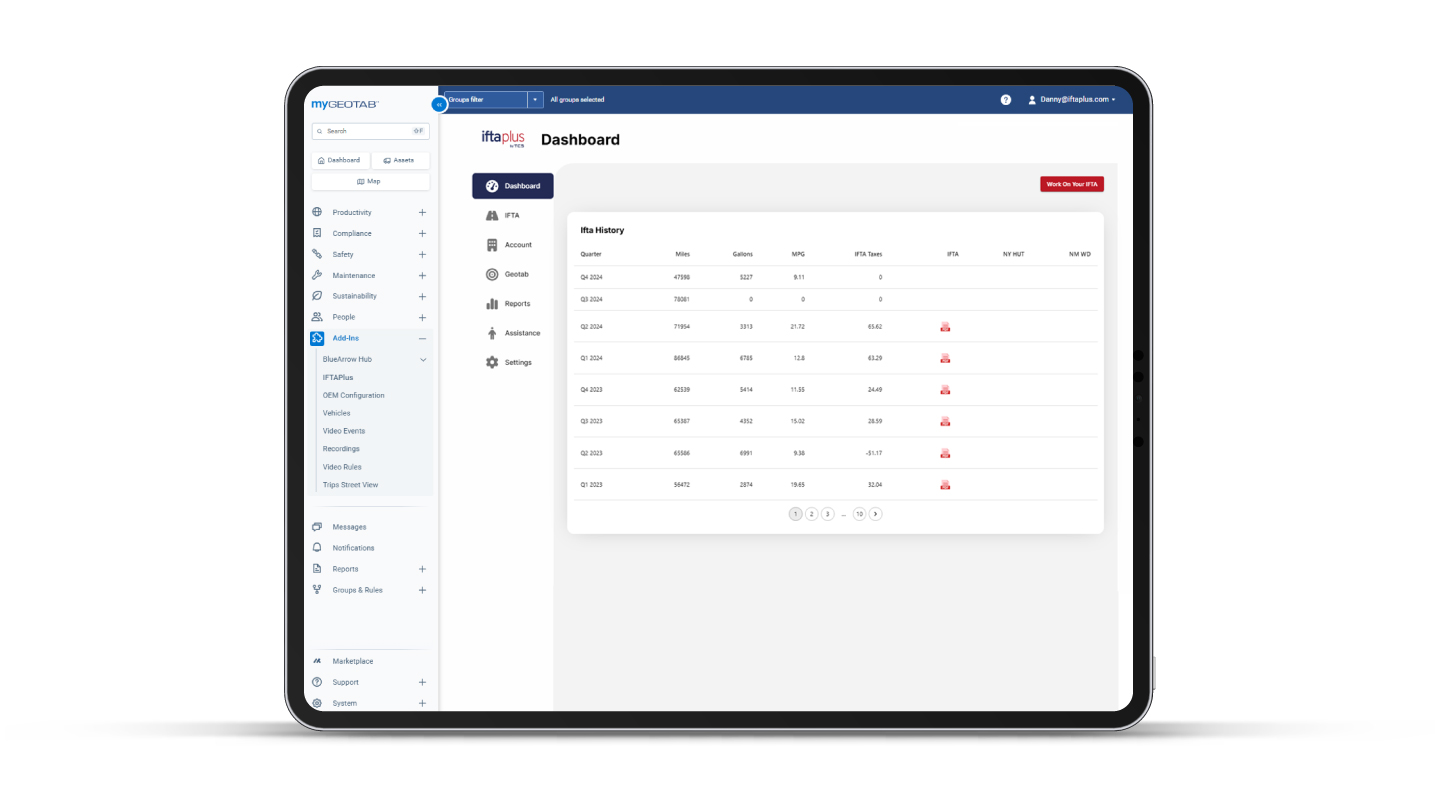

IFTA Plus is built to protect you from these risks and help you get this right.

With IFTA Plus, you can

- Organize & lay out your mileage and fuel records in one place

- Audit & identify missing or incomplete records before you file

- Spot discrepancies between what’s reported and what’s actually required

- Generate accurate, ready-to-file tax forms

How to manage your IFTA correctly

IFTA Plus is built to protect you from these risks and help you get this right.

With IFTA Plus, you can

- Organize & lay out your mileage and fuel records in one place

- Audit & identify missing or incomplete records before you file

- Spot discrepancies between what’s reported and what’s actually required

- Generate accurate, ready-to-file tax forms

How can we help you?

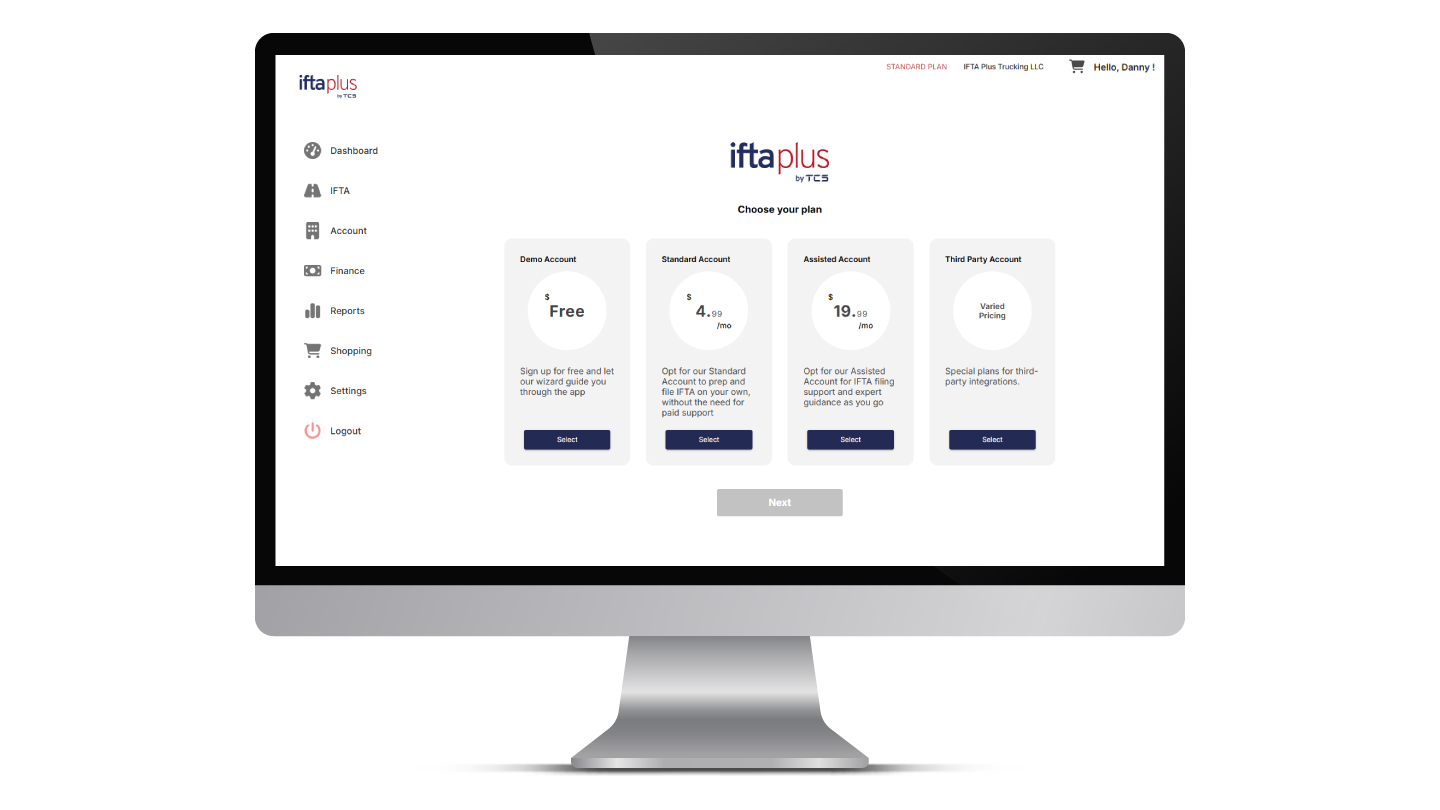

Discover how IFTA Plus can optimize your filing

Flexible Account Options

IFTA Preparation

NYHUT Preparation

NMWD Preparation

IRP Reports