Innovation

- Complete fuel tax calculations for all IFTA Jurisdictions including Canada.

- Supports State-specific report formats.

- Bulk data upload or manual data entry.

- Industry leading bill back report.

- Offers industry standard reporting.

- New businesses tools coming Fall 2023!

Certified

- Over 15 years in business.

- Authorized IRS e-file provider.

- State 3rd party certified with 30 state jurisdictions.

- Over 10,000 trucks filed through IFTA Plus last year.

- Our partners, Geotab, Wex.

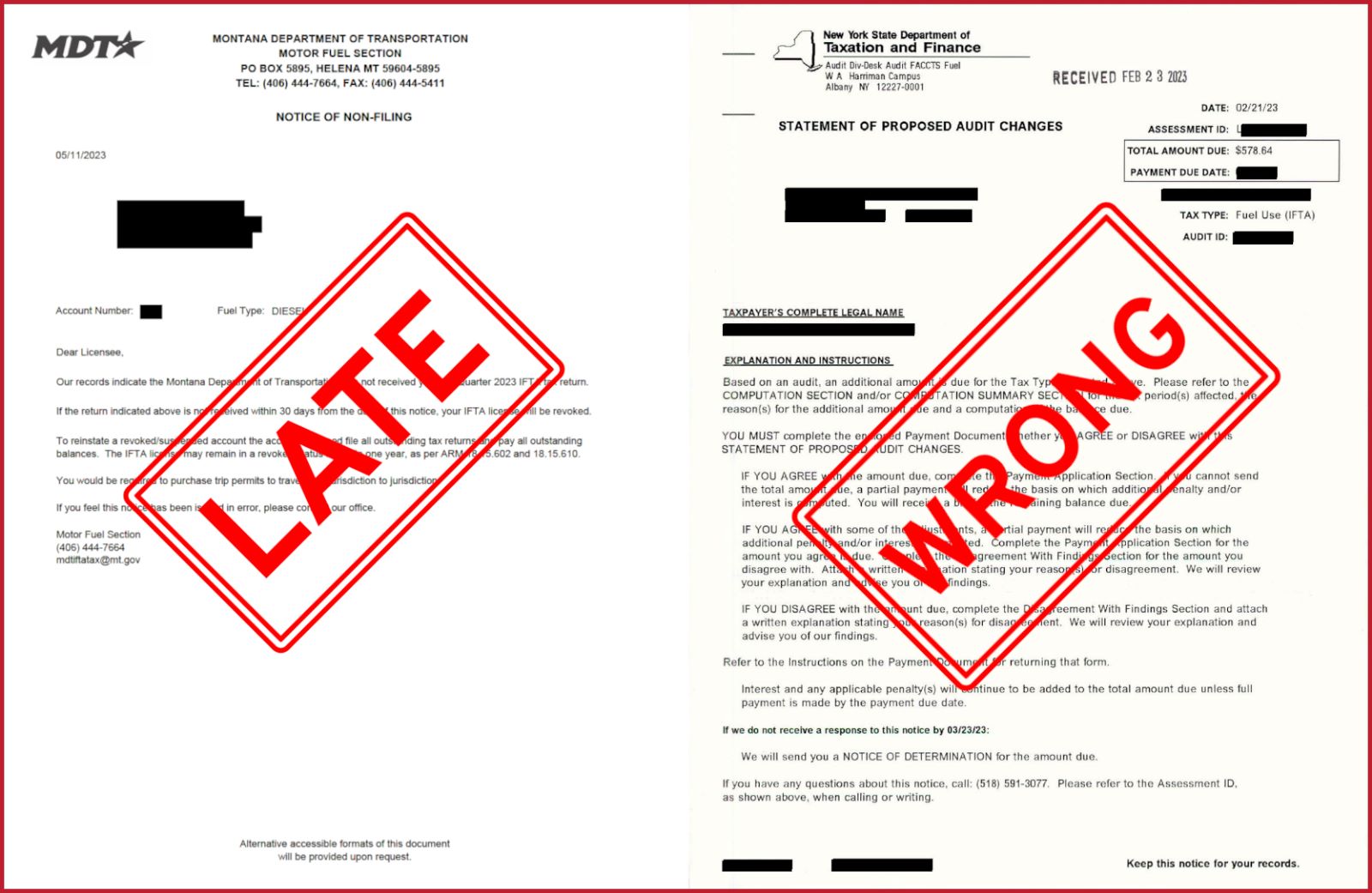

The Problem

Protect yourself. Confirm with data. File your taxes accurately!

Without a system like IFTA Plus, it is nearly impossible to ensure a correct fuel tax filing is being submitted to the state each quarter.

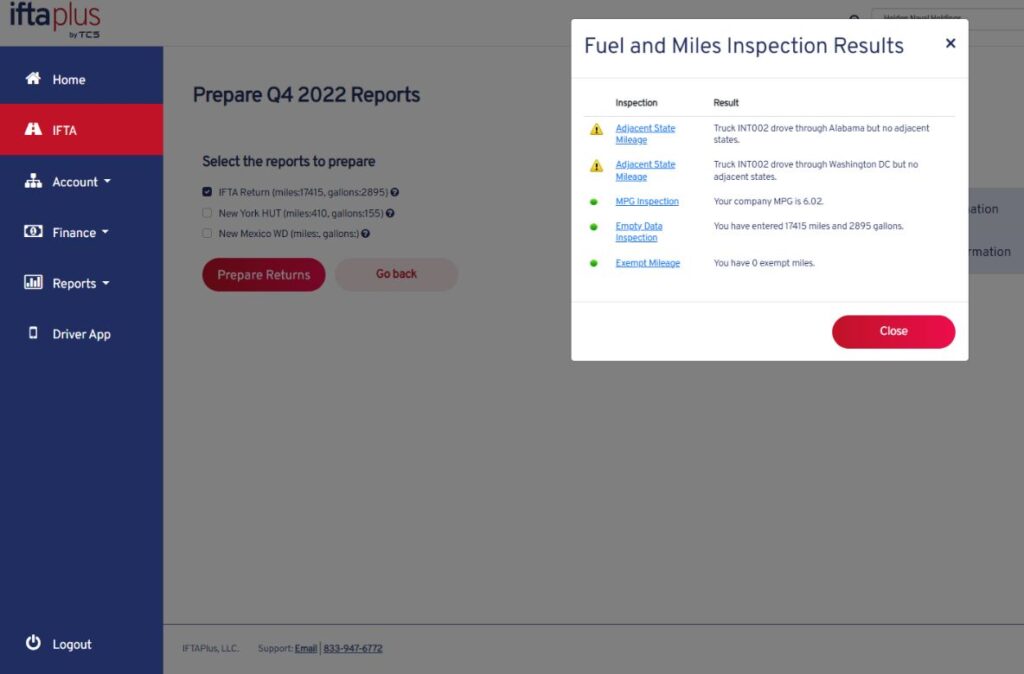

You will be able to easily detect errors using the IFTA Plus management tools. Use our map feature to check adjacent states, mpg reports and our IFTA Plus Pre-Filing Error Diagnosis to help ensure correct filings are submitted to that state.

Do not trust IFTA reports from providers which subtotal your mileage and fuel. Confirm with data. Why?

Most account holders rely on exported quarterly mileage reports from ELD companies and fuel data from Card companies to then enter this data blindly into state portals or state filing documents. This is extremely risky and many times this will lead to mis filings.

The Solution Using IFTA Plus

- Enter all trucks information completely at the truck level including truck number.

- Enter all mileage per truck number separately (bulk upload recommended)

- Enter all fuel per truck number separately (bulk upload recommended)

Then….

- Use IFTA Pre-Filing Error Diagnosis tool, check errors.

- Run MPG report, check errors.

- Prepare and file.

It’s that Easy!